What sports bettor doesn’t dream about an amazing run of back to back

wins for weeks on end? Well, there is one way to guarantee a profit

while placing bet, arbitrage betting. Arbitrage sports bets are

otherwise known as sure bets. That is because no matter the outcome of a

certain event or match, the punter is guaranteed a profit. Yes, this is

legal and is not cheating.

Arbitrage is a financial term which means to make a risk-free profit.

In the world of finance it is done by taking advantage of pricing

imbalances in markets. This is used often in currency exchange markets,

but can be applied to anything where several trades can be executed

simultaneously such as bonds, derivatives, commodities, and stocks. With

electronic trading, there are computer programs continuously looking

for these instant guaranteed profit opportunities. Arbitrage hunters

actually help to correct the market and make it more ‘efficient’ by

correcting price disparities often within seconds after they occur.

The same opportunity exists in the sports betting world. Think of the

odds offered by bookmakers as prices on a certain outcome. Since

different bookmakers often times offer different odds, arbitrage

opportunities sometimes arise where bettors can take advantage of price

disparities in the odds, where no matter the outcome of an event, the

bettor is guaranteed a profit.

Sounds too good to be true doesn’t it? Well, there is a catch. It

takes work to find the opportunities and a bit of practice to make sure

that you are proficient enough not to make the wrong series of bets,

that may increase your risk, or worse, rather than guaranteeing you a

profit, guaranteeing a loss. The profit margins on these bets tend to be

low, but again, they are guaranteed. It is considered ‘found’ or free

money if you can identify a sure bet.

How Arbitrage Guarantees Profit

There is a mathematical way to view arbitrage through formulas;

however, sometimes variables can make your head spin and complicate

something that really is quite simple to understand. I don’t want you to

be intimidated as it is something that is fairly elementary in concept.

I will start out with a simple illustration and follow it with the

formulas; the math will hopefully be more intuitive this way. For this

example, we will look at only two possible outcomes (win or loss). We

will use theoretical odds offered by two different

cricket bookmakers,

Bookmaker A and Bookmaker B. Again, this is the most basic example, but

it can be applied to multiple outcomes and multiple bookmarkers.

Let’s say we have an IPL cricket match between the Chennai Super

Kings and Mumbai Indians with only two possible outcomes Kings Win or

Indians Win.

| Outcome |

Bookmaker A |

Bookmaker B |

| 1: Chennai Super Kings Win |

1.5 |

1.75 |

| 2: Mumbai Indians Win |

2.5 |

2 |

I will say first that there is an arbitrage opportunity in this scenario. I will show you later how to find it.

In order for arbitrage to be possible, we must create a betting

scenario where the payout in either outcome is the same and where the

total bets required equal less than the guaranteed payout.

In this scenario, if I place a £100 bet on a Chennai Super Kings Win

at Bookmaker B with odds of 1.75, the payout will equal £175. If I bet

£70 at Bookmaker A on a Mumbai Indians Win with odds of 2.5, that will

also give me a payout of £175.

Notice that in this scenario I have made two bets for a total of £170

(£100 + £70), but in either outcome I will receive £175. This

guarantees me a profit of £5 for every £170 invested. This is a risk

free profit of 2.9%. Hey, I never said the profit margins would be huge,

but they are guaranteed!

Keep in mind that is a 3% return for the time period until the match

concludes. So, if take the position the day of the match, that is a 3%

return for the day. That is an annualized return of over 1000%. Again,

risk free!!

See our

Arbitrage Tool (excel spreadsheet) to see how this example works. You can change the odds to show different outcomes.

This is another way to look at the investments and payouts:

| |

Kings Win |

Indians Win |

| Total Investment |

£170 (£100 + £70) |

£170 (£100 + £70) |

| Payout |

£175 |

£175 |

| Profit/Loss |

£5 Profit |

£5 Profit |

Arbitrage and Profitability Formulas

As I said before, I wanted to show how the concept of arbitrage

worked first before getting into the math. If you were never good at

advanced math, don’t worry, it isn’t has hard as it may look. Just keep

reading. I will explain everything.

We will refer to this table of variables when showing the formulas (seriously, keep reading):

| Variable |

Explanation |

|

s1

|

Stake in outcome 1 |

|

s2

|

Stake in outcome 2 |

|

o1

|

Odds for outcome 1 |

|

o2

|

Odds for outcome 2 |

|

p1

|

Payout of outcome 1 |

|

p2

|

Payout of outcome 2 |

Bookmaker Profit Margin

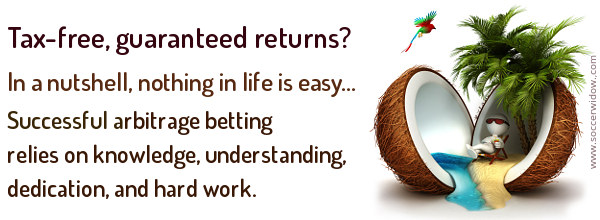

To find out IF a bookmaker’s odds are profitable for them, we can use the following equation:

o1-1 + o2-1 > 1

Another way to say this is the “sum of the inverse of odds” must be

greater than 1 for the sports book to be profitable. If it is not, the

sports book stands to lose money on its own odds. In fact, there would

an arbitrage opportunity using the odds of both outcomes by the same

sports book. Don’t count on that ever happening as a sports book that

made a habit of it would go out of business very quickly.

So, let’s see if Bookmaker A is profitable using the odds above. Outcome 1 Odds = 1.5, Outcome 2 Odds = 2.5

1.5-1 + 2.5-1 = 1.0667

1.0667 > 1

Since the sum of the inverse is greater than 1, we know that Bookmaker A will be profitable for the bets they are offering.

Now let’s find out the actual profit margin of Bookmaker A.

Bookmakers purposely price their odds in a way so that they take a cut

for their services; after all, they need to eat too. Typically, you will

find that the margins are between 8 – 12%. To find their margin on an

event, you will need the following formula:

1 – (o1 x o2)/(o1 + o2) = Bookmaker Event Profit Margin

Looking back to our initial example, let’s find the profit margin of

Bookmaker A. In this case Outcome 1 was a Super Kings Win with odds of

1.5. Outcome 2 was an Indians Win with odds of 2.5.

So, to find the profit on this event for Bookmaker A, we will use the following calculation:

1 – (1.5 x 2.5)/(1.5 + 2.5) = .0625 or 6.25%

This means that Bookmaker A will expect to earn a profit margin of 6.25% on the match up.

How to Find an Arbitrage Opportunity

In the same way that we found out if bookmaker was profitable using the equation:

o1-1 + o2-1

The difference here is that we want the “sum of the inverse” to be

LESS than 1. Notice that in this case we are comparing the odds of two

Bookmakers as we are assuming that both are offering their own odds

which are profitable for them. However, if you ever find a bookmaker

that is not profitable, where the sum of the inverse of their own odds

is less than 1, then there is an arbitrage opportunity using the odds on

both outcomes offered by that same bookmaker.

Again, using the same example before:

| Outcome |

Bookmaker A |

Bookmaker B |

| 1: Chennai Super Kings Win |

1.5 |

1.75 |

| 2: Mumbai Indians Win |

2.5 |

2 |

Let’s use the odds of Bookmaker B for outcome 1 (1.75) and the odds of Bookmaker A for outcome 2 (2.5).

1.75-1 + 2.5-1 = .0971

.0971 < 1

Since the sum of their inverse is less than 1, this indicates that an arbitrage opportunity is present.

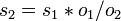

How to Guarantee Profits Using Arbitrage

Now that we have identified an arbitrage opportunity, let’s take

advantage of it. We know it will be profitable to bet on a Super Kings

Win at Bookmaker B while also betting on an Indians Win at Bookmaker A.

Remember, as explained before, in order for it to be arbitrage, we

must guarantee equal payouts for all outcomes, where the bets required

are less than this guaranteed amount.

Let’s bet £300 on the Super Kings Win at Bookmaker B. This would give

us a payout of £525 (£300 x 1.75) if the Super Kings won. Now we want

to place a bet that will yield a payout of £525 if the Indians win using

the odds from Bookmaker A.

To find out what we will need to bet for Stakes 2, simply use the following calculation:

p1 / o2 = s2 => (£525/2.5) = £210

So, we would bet £300 on a Super Kings Win with Bookmaker B and £210

on an Indians Win with Bookmaker A for a total of £510. No matter the

outcome of the event, whether the Kings win or the Indians win, we

will receive a payout of £525 for a guaranteed profit of £15.

I Never Said it was Easy

As I mentioned before, sure bets require a bit of practice and work

to find them. As you noticed the profit margins are also not very large,

typically they are around 4%, but remember that is an annualized return

of 1200%. If you could accomplish this everyday you would end up with a

tidy profit. However, the opportunities are not always obvious and

quickly go away as punters take advantage of the opportunity.

The key is that you must make both bets simultaneously. If you don’t,

you risk the odds changing from your first bet to the second bet which

can destroy your opportunity. This element of risk would disqualify it

from being arbitrage.

Keep in mind that you can also use this with naked bets (bets that

only count on one outcome) if you decide to hedge later on. If you took a

bet earlier in the week on the Kings for 1.75 but you are losing

confidence in your bet, you can lock in profits if you find favorable

odds, instead of risking your entire first bet.

Using this as a Hedge, Not Arbitrage

You can also use it to partially hedge an outcome, where instead of

betting so that you will receive the same payout in either case, you

partially cover your downside by betting less. However, that of course

would not be arbitrage as it is not guaranteed profit.

An example of this would be as follows: suppose you placed a £300 bet

on the Kings to beat the Indians using the same odds as before of 1.75.

Now, let’s say that later on you find odds of 2.5 for the Indians to

win. As we found out before, there is sure bet opportunity if you want

it because of the favorable odds, but if you only want to cover part of

your total £300 risk, you can bet any amount below £210 on the Indians

at the 2.5 odds which will cover your losses if the Kings don’t win.

Let’s say you bet $100 on the Indians to win.

| |

Kings Win |

Indians Win |

| Total Investment |

£400 (£300 + £100) |

£400 (£300 + £100) |

| Payout |

£525 |

£250 |

| Profit/Loss |

£125 Profit |

£150 Loss |

Notice that if you stuck with your original bet of £300 on the

Kings and they lost, you would lose all £300, whereas with this hedge

you will only lose £150. However, if the Kings win, instead of winning

£225 in profit, you only win £125. In this case, you reduced your

upside, but also reduced your potential downside, which is known as

hedging your bet. Whether you use hedges or not has to do with your

personal betting strategy how you want to utilize it.

If you still need some more help, be sure to see our

Arbitrage Tool (excel spreadsheet) which might help you get a better idea of how it works.

The Real Catch

Because of the terms and conditions of most bookmakers, there is

never any truly risk free profit. Most reserve the right to cancel bets

at any time before the event. This means that if you made

an arbitrage bet between two bookmakers and Bookmaker A cancels, it

leaves you wide open to the full risk of the bet you placed at Bookmaker

B. If you can find two sites that don’t have these terms, you will be

able to do it, but good luck with that as they likely do not exist. At

least we haven’t found any that do.

Note: The bookmakers reserve this right to protect themselves

from unbalanced odds on their own books by canceling bets and refunding

wagers. However, bookmakers rarely cancel bets as this rightly upsets

their customers and lowers their reputation. It only occurs in

extreme situations where they have made a huge miscalculation with their

odds.

Federata Shqiptare e Futbollit ka zyrtarizuar dy miqësoret e muajit nëntor të kombëtares së Shqipërisë.

Federata Shqiptare e Futbollit ka zyrtarizuar dy miqësoret e muajit nëntor të kombëtares së Shqipërisë.

and

and

,

which is the amount the bookmaker earns on offering bets at some event.

Bookmaker 1 will in this example expect to earn 5.34% on bets on the

tennis game. Usually these gaps will be in the order 8 - 12%. The idea

is to find odds at different bookmakers, where the sum of the inverse of

all the outcomes are below 1, meaning that the bookmakers disagree on

the chances of the outcomes. This discrepancy can be used to obtain a

profit.

,

which is the amount the bookmaker earns on offering bets at some event.

Bookmaker 1 will in this example expect to earn 5.34% on bets on the

tennis game. Usually these gaps will be in the order 8 - 12%. The idea

is to find odds at different bookmakers, where the sum of the inverse of

all the outcomes are below 1, meaning that the bookmakers disagree on

the chances of the outcomes. This discrepancy can be used to obtain a

profit.

on outcome 2 at bookmaker 1 would ensure the bettor a profit.

on outcome 2 at bookmaker 1 would ensure the bettor a profit. from bookmaker 2. In case outcome 2 comes out, one could collect

from bookmaker 2. In case outcome 2 comes out, one could collect  from bookmaker 1. One would have invested $136.67, but have collected

$143, a profit of $6.33 (4.6%) no matter the outcome of the event.

from bookmaker 1. One would have invested $136.67, but have collected

$143, a profit of $6.33 (4.6%) no matter the outcome of the event. . If one wishes to place stake

. If one wishes to place stake  at outcome 2, to even out the odds, and receive the same return no matter the outcome of the event.

at outcome 2, to even out the odds, and receive the same return no matter the outcome of the event. for outcome 3 with their respective bids being

for outcome 3 with their respective bids being  ,

,  and

and  and sum of the bids being B.

and sum of the bids being B.